Nextpower (NXT)·Q3 2026 Earnings Summary

Nextpower Beats on Revenue and EPS, Raises FY26 Outlook — Stock Jumps 7% After Hours

January 27, 2026 · by Fintool AI Agent

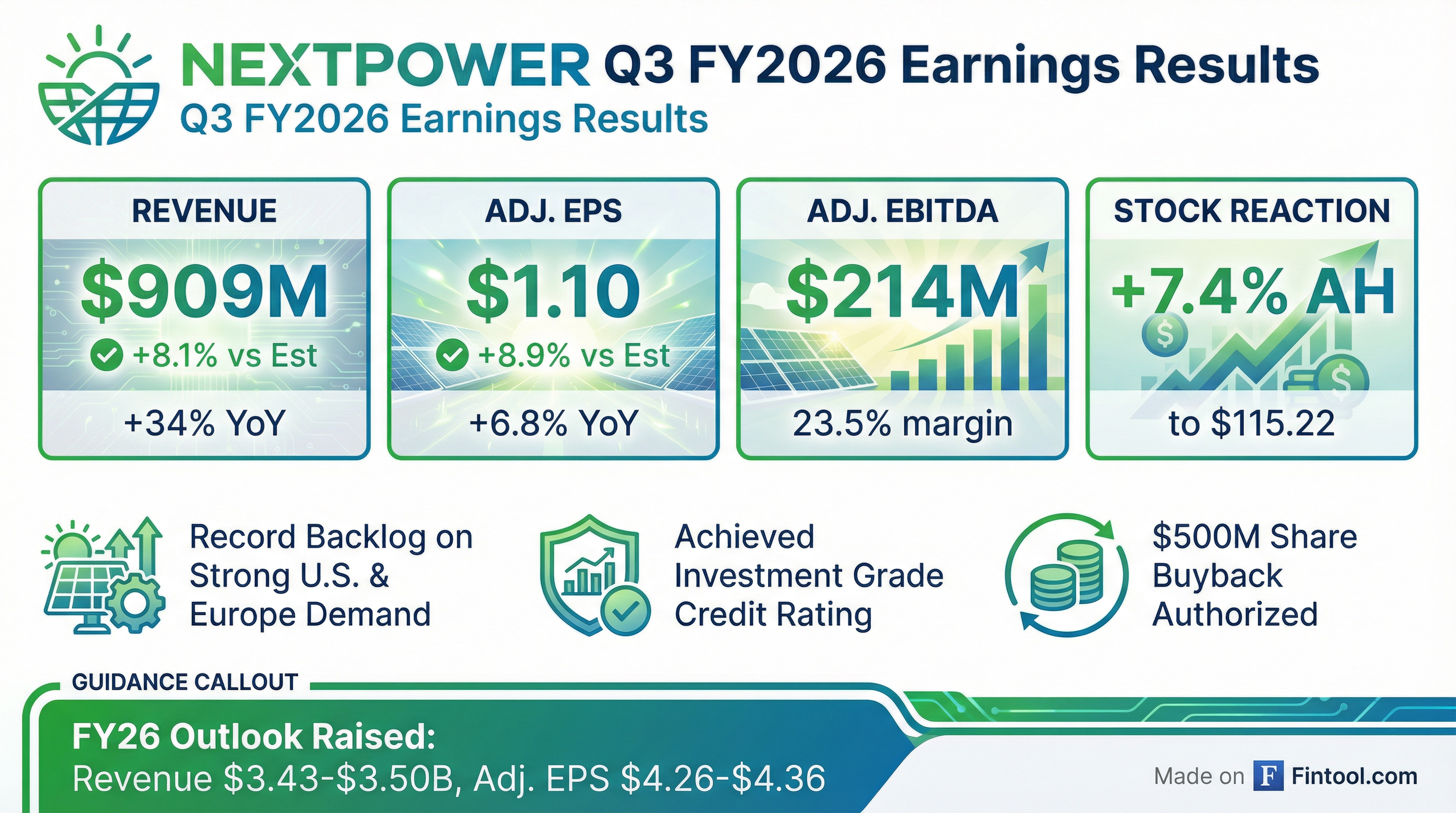

Nextpower (NXT) delivered a strong Q3 FY2026 with double-digit beats on both revenue and EPS, raised full-year guidance, and announced a $500 million share buyback program. Shares jumped 7.4% in after-hours trading to $115.22 following the release.

The solar tracking and energy technology company, formerly known as Nextracker, reported revenue of $909 million (+34% YoY) and adjusted EPS of $1.10 (+6.8% YoY), both exceeding Wall Street expectations. Management attributed the strong performance to record backlog driven by robust U.S. and European demand.

Did Nextpower Beat Earnings?

Yes — Nextpower delivered solid beats on both top and bottom lines:

This marks a continuation of Nextpower's beat streak. Over the past 8 quarters, the company has consistently exceeded EPS estimates:

What Did Management Guide?

Nextpower raised its full-year FY2026 guidance across all key metrics:

The guidance raise reflects confidence in bookings momentum and execution. CFO Chuck Boynton noted: "Supported by the strength of our bookings and execution, we are raising our FY26 outlook."

Key assumption: Management's outlook assumes the current U.S. policy environment remains intact and permitting timelines stay consistent with historical levels. They flagged potential regulatory actions as a monitoring risk.

How Did the Stock React?

NXT shares responded positively to the beat-and-raise quarter:

The after-hours pop pushed shares to a new all-time high, breaking above the previous 52-week high of $112.74. This reflects the market's enthusiasm for the beat, guidance raise, and capital return announcement.

What Changed From Last Quarter?

Several notable developments this quarter:

1. Rebrand to Nextpower

The company officially rebranded from Nextracker to Nextpower at its inaugural Capital Markets Day, reflecting its evolution from a pure-play tracker supplier to an end-to-end solar technology platform.

2. Investment Grade Credit Rating

Fitch assigned an investment grade rating, recognizing the company's strong cash flow generation, disciplined financial management, and balance sheet strength.

3. $500M Share Buyback Program

The board authorized repurchases of up to $500 million of common stock over three years, signaling confidence in cash flow sustainability.

4. Nextpower Arabia Joint Venture

Completed formation of a joint venture targeting the rapidly growing utility-scale solar market in the Middle East and North Africa (MENA) region. Secured a 2.25 GW supply commitment for the Bisha Solar Project, one of the world's largest utility-scale solar plants.

5. Margin Compression (As Expected)

Gross margin declined to 31.7% from 32.4% last quarter and 35.5% in Q3 FY25, reflecting mix shift and IRA 45X credit dynamics. Adjusted EBITDA margin was 23.5% vs 24.7% sequentially.

6. Tariff Impact Escalation

Tariff impact increased to $44M in Q3 (up from $33M in Q2) as the company absorbed the full quarter impact of tariffs effective August 15. Management noted this is manageable given their diversified supply chain and 25+ U.S. manufacturing partners.

Key Financial Trends

Key Observations:

- Revenue growth remains robust at 34% YoY despite a high base

- Gross margins have compressed ~400bps over 4 quarters, consistent with guidance

- Adjusted EBITDA dollars remain stable at $214M despite margin pressure

- EPS declined sequentially but remains well above year-ago levels

Balance Sheet & Cash Flow

Nextpower ended Q3 with a fortress balance sheet:

The debt-free balance sheet and strong cash generation supported the investment grade rating from Fitch and enabled the $500M buyback authorization.

Business Highlights

Record Backlog: Achieved record backlog driven by strength in the U.S. and record bookings in Europe. Expanded global footprint to two new countries.

Product Innovation:

- Increased bookings for bundled offers including a 552 MW project in Cold Creek, Texas incorporating NX Horizon Hail Pro™ tracker systems, eBOS, NX Earth Truss, and TrueCapture®

- Announced power conversion solutions roadmap for utility-scale solar and energy storage

- Acquired Fracsun, a panel soiling measurement and SaaS platform

Geographic Expansion:

- Launched NX Earth Truss™ in Australia

- Nextpower Arabia JV addresses MENA opportunity

- Opened Southeast operations hub with new Remote Monitoring Center

Key Quotes From Management

CEO Dan Shugar on demand:

"Customer response to our expanding product offerings and rebrand has been very favorable. We delivered solid financial performance in our first quarter as Nextpower, with strong demand across our business lines and a record backlog. The demand environment remains robust in the U.S. and other global markets."

CEO Dan Shugar on the MENA opportunity:

"Saudi Arabia and the surrounding GCC sit at the center of one of the most dynamic energy transitions in the world. Rapid growth in electricity demand, driven by economic transformation, mega projects, and the expansion of AI and digital infrastructure, calls for solutions that can scale quickly, reliably, and efficiently."

CFO Chuck Boynton on capital allocation:

"Our strong financial performance and disciplined capital allocation continue to strengthen Nextpower's financial position. We achieved an investment grade credit rating and announced a share repurchase program with authorization for repurchase of up to $500 million of our common stock over three years, reflecting confidence in our cash flow generation and balance sheet strength."

CFO Chuck Boynton on investment grade importance:

"Investment grade rating is important to all customers and suppliers. Internationally, it makes a big difference. If you're working with a large developer or owner, they care deeply about the credit profile of their counterparty... It's really a testament to how well the company's managed and the disciplined approach that we take to operating our business."

CEO Dan Shugar on long-term relationships:

"We're really seeing long-term ability to support the development, finance, supply, operation, spare parts, warranty reserve, overlay for the project really be a much more important attribute as the industry's matured and gone to long-term risk-adjusted, levelized cost of energy optimization."

Risks & Considerations

-

Margin Pressure: Gross margins have compressed ~400bps over four quarters. While revenue growth offsets this at the dollar level, further erosion could weigh on profitability.

-

Policy Dependency: Guidance assumes current U.S. policy environment (IRA benefits) remains intact. Management flagged regulatory actions as a monitoring risk.

-

Backlog Conversion: While backlog is at record levels, the ability to convert this to revenue depends on customer project timelines and permitting processes.

-

Valuation: At $115 after-hours, NXT trades at ~26x the midpoint of FY26 adjusted EPS guidance ($4.31), demanding continued execution.

What's Next?

- Q4 FY26 Report: Expected late April / early May 2026

- Share Buyback Execution: Management indicated it will be a "structured program" rather than purely opportunistic, but they're going "slow and cautious out of the gates" as first-time repurchasers

- Power Conversion Beta Projects: Customer pilots planned for calendar year 2026

- FY2027 Outlook: Q1 FY27 expected to be "strong and up and to the right" — full guidance update likely at Q4 earnings

Q&A Highlights

Bookings & Backlog

Philip Shen (Roth) asked about book-to-bill and whether bookings cleared $1B. Howard Wenger responded:

"Bookings were strong... It was one of our stronger quarters that we've had in some time... It was a little bit weighted to the United States."

Management declined to give a specific number but confirmed backlog is now at a new record above $5B, with strong bookings momentum.

Federal Lands Permitting

Praneeth Satish (Wells Fargo) asked about the permit freeze impact. CEO Dan Shugar clarified:

"Several projects that are on federal lands are now moving forward... Developers are navigating. They're very safe harbored. They have a lot of visibility into the future."

Howard added that most developers have limited federal lands exposure, and pipelines are "broadening and growing."

Bundled Attach Rates

Dimple Gosai (Bank of America) asked about attach rates for TrueCapture, eBOS, and NX Earth Truss. Howard noted:

"The pipeline is expanding exponentially in terms of opportunities... We're seeing some very significant projects. The one we highlighted is a 552 MW project where we have our trackers, foundations, eBOS, and TrueCapture all bundled together."

On non-tracker margins, CFO Chuck Boynton said they're "roughly at the corporate average" for gross margins, with software "quite a bit higher."

Tariff Impact Details

The tariff impact increased to $44M in Q3 (up from $33M in Q2) due to the full quarter impact of tariffs effective August 15.

"Our diversified and increasingly localized supply chain, combined with pricing discipline and operational execution, has allowed us to manage these impacts efficiently. We work with over 25 U.S. partner manufacturing facilities."

Saudi Arabia JV Structure

Deshantel (Jefferies) asked about JV economics. CFO Chuck Boynton explained:

"It's structured as roughly a 50/50 JV. We will not consolidate... It fits well with our heroic capital-light model. When the JV sells projects, we effectively will generate revenue by selling some technology into the JV. There'll be a royalty. And then our share of the JV's profits."

Dan Shugar added the JV is already delivering on the 2.25 GW project this quarter, with an existing factory in Riyadh and a new factory under construction in Jeddah.

Power Conversion Update

Deshantel (Jefferies) asked about power conversion customer conversations. Howard Wenger explained:

"Power conversion has been the opportunity for greatest operational performance improvement of solar and batteries for a long time... The number one item on the radar to improve operating fleets around the world is to have better reliability and performance of this particular category."

The company has operating alpha units and plans customer beta projects in calendar year 2026.

AI & Hyperscaler Demand

Ben Kallo (Baird) asked about "bring your own power" trends. Dan Shugar clarified:

"Almost all of what's happened and happening is [power through the grid, not co-located]... A huge amount of our projects with our customers are for serving hyperscalers, data centers buying energy to support their operations. That's been happening for more than 5 years."

Storage Opportunity

On the battery storage market, Dan noted:

"Solar and storage go together, kind of like bass, guitar, and drums go together... Our inverter platform can definitely support both [solar and storage]. It was conceived that way."

He highlighted the evolution from 1-hour to 4-hour storage as standard, with some projects now at 6-8 hours, and one UAE project at 24-hour storage.

FY27 Outlook

Management declined to update FY2027 guidance from Capital Markets Day (just 2 months ago) but expressed confidence:

"Q1 FY27 looks very strong and up and to the right... We're very pleased with our backlog, and it really gives us visibility to manage the company on an annual basis."